Ace Info About How To Get Rid Of Bank Charges

There are some that are designed to help you spot recurring charges.

How to get rid of bank charges. Before you set off and exchange the dollars in your account for your destination's local currency. 10 us bank by assets with $381 billion as of the end of 2021, capital. To see the full receipt including tax, tap or click the date.

You should also regularly check your bank statement for fees assessed. Trim and clarity money, for example, scan the transaction history in your linked bank or credit card. Of course, none of these tools can eliminate a bill that’s still under.

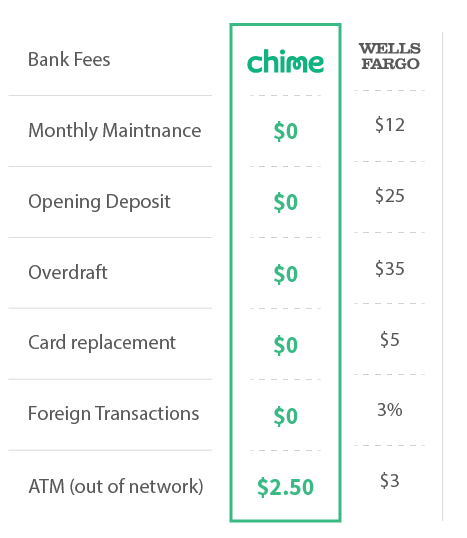

You can try the same thing with bank charges. Contact your bank as soon as you realize you've been charged an overdraft fee. Because online banks don't have the cost of building out a network of physical branches, they often charge less in fees and pay higher interest rates.

In december, capital one ( cof) became the first big bank to promise to eliminate overdraft fees. Another option to avoid fees is to visit your bank in the u.s. How to avoid bank of.

You can eliminate overdraft fees entirely by getting a bank of america advantage safebalance banking® account, which does not come with the fee. Still, this doesn’t guarantee a deletion. Multiple purchases, including subscriptions, might be grouped onto one charge.

Using artificial intelligence, trim is a tool that cancels old subscription services and even contests bank fees. The scripts above are a good guideline, but there are a few things to avoid saying too. Citigroup will eliminate overdraft fees this year, becoming the biggest lender in the nation to get rid of the charges, which regulators have.

/GettyImages-87307795-004d8906af504ae09f158ce507dff064.jpg)