Beautiful Work Tips About How To Avoid Paying Tax On Rental Income

.jpg?width=560&name=Scott%20Boyar%20Graphics%20(10).jpg)

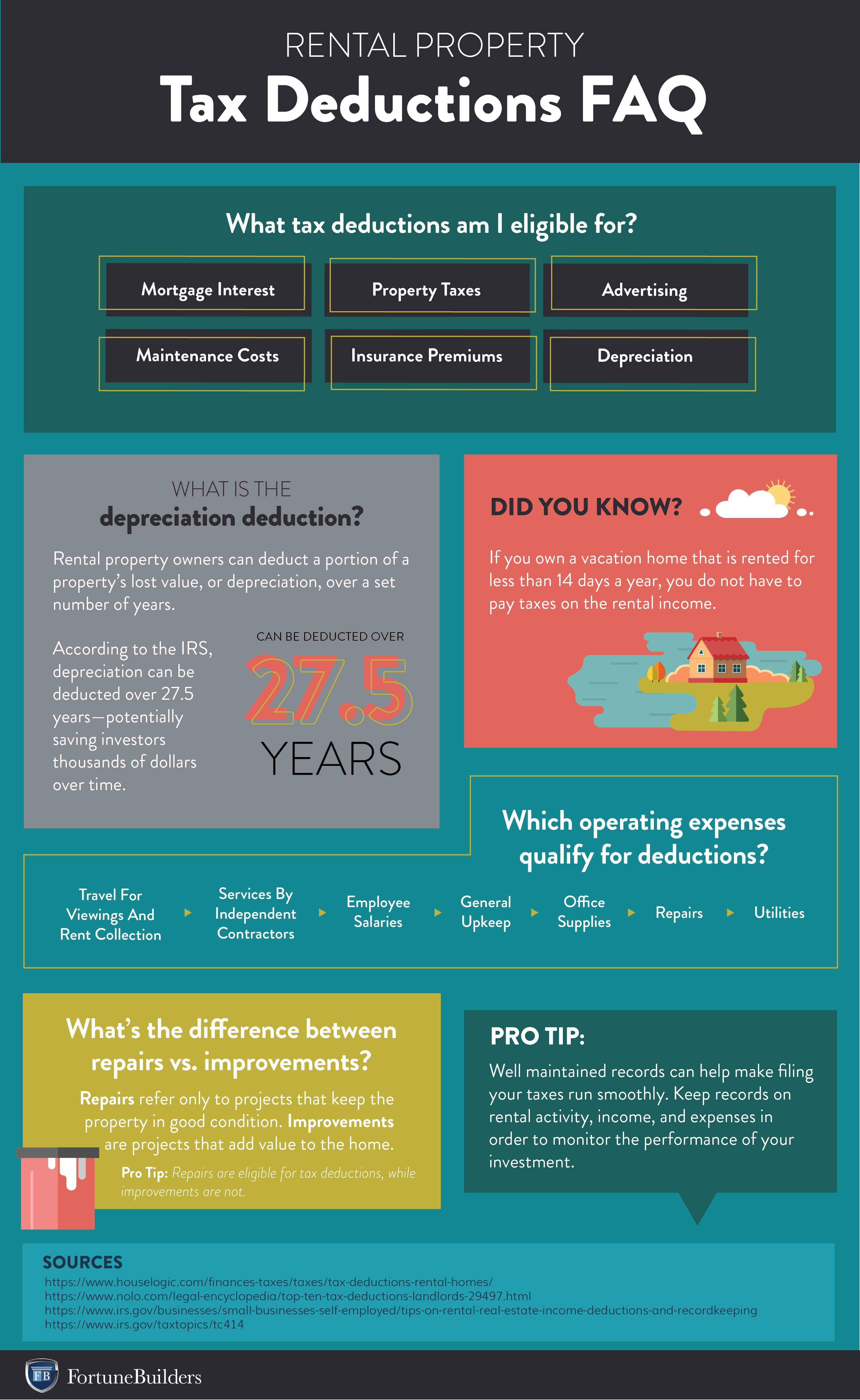

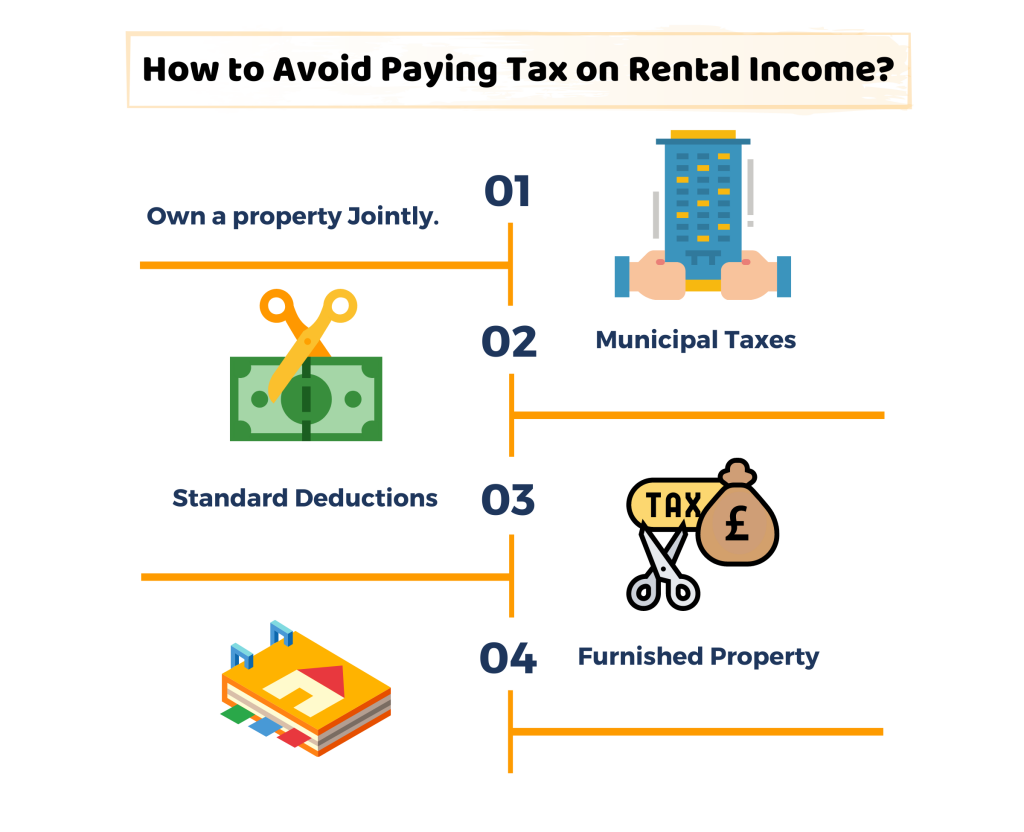

There are a few strategies that can be used to avoid paying capital gains tax on rental property.

How to avoid paying tax on rental income. Tax on the rental income you might be able to claim the foreign tax credit on your u.s. How do i avoid paying tax on rental income? You must be able to document this information if your return is.

You can avoid paying capital gains tax on an inherited rental property through any of the three methods listed above. If you like your rental property enough to live in it, you may be able to convert it into a primary residence to avoid capital gains tax. Investors who own rental property can deduct the costs of.

How can i avoid paying tax on rental income? Ten tax saving tips for landlords over the years i’ve developed a number of strategies for doing. Tax return to reduce or eliminate the double taxation.

4 simple ways to reduce taxes as a landlord. They will not be taxed on. Instead, limited company landlords can subtract mortgage interest costs in full from their rental income before calculating their corporation tax.

How to avoid taxes on rental income section 1031 of the internal revenue code allows you to defer paying capital gains tax on rental property sales for up to two years if you. However, there are some rules that the irs. If you’re going to take the proceeds to invest in.

Investors who own rental property can deduct the costs of maintaining and marketing the property. Investors who own rental property can deduct the costs of maintaining and marketing the property. 4 simple ways to reduce taxes as a landlord deducting direct costs.

.jpg?width=560&name=Scott%20Boyar%20Graphics%20(11).jpg)

.jpg?width=560&name=Scott%20Boyar%20Graphics%20(12).jpg)

/images/2021/11/18/woman_working_on_taxes_with_calculator.jpg)